However, particular pupil checking membership really go that step further to attenuate charge. They wear’t charges month-to-month restoration fees, or they make simple to use in order to waive the individuals costs that have pupil condition. Almost every other features is very early use of lead put, use of as much as 60,100000 payment-free ATMs, robust cellular financial, and you may free access to Zelle. You could couple their Find savings account which have Fruit Shell out®, and your bank account balance try FDIC-insured to the absolute most invited.

Come across a money You to definitely Café otherwise lender branch in your area.

Other factors, such as our own proprietary site laws and regulations and whether or not a product exists near you or at your self-picked credit score diversity, also can feeling exactly how and where items show up on this site. Once we try to provide a variety of https://realmoney-casino.ca/no-deposit-bonus-big-dollar-casino/ also offers, Bankrate doesn’t come with information regarding all monetary otherwise borrowing from the bank device or provider. BrioDirect’s Large-Yield Bank account now offers an aggressive yield, nonetheless it needs a steep minimal put from $5,one hundred thousand to open. When you open the newest membership, you can keep less money involved if you’d like, but you will you want at the very least $twenty five to make the brand new bank’s large-yield deals APY. Remember that BrioDirect does not provide any profile today.

Today you can secure step three.60% to your its flagship savings account, versus 0.87% about ten years ago when inflation is below the Fed’s dos% target. We foot our very own choice on what financial institutions and you will items to add inside our listing entirely for the another methodology, which you’ll find out more on the below. U.S. Lender in past times considering a great $450 examining bonus to have beginning a different membership.

Neither Pursue nor Zelle® also provides compensation to have registered costs you create having fun with Zelle®, apart from a restricted reimbursement system you to can be applied for sure imposter cons the place you delivered money which have Zelle®. That it reimbursement system is not required by-law and could end up being changed otherwise discontinued any moment. Same webpage link efficiency to help you footnote site 2Your qualifying financial must end up being connected and you can enrolled in automated repayments on the working day before end of one’s statement several months.

Pursue Bank (Full Examining)

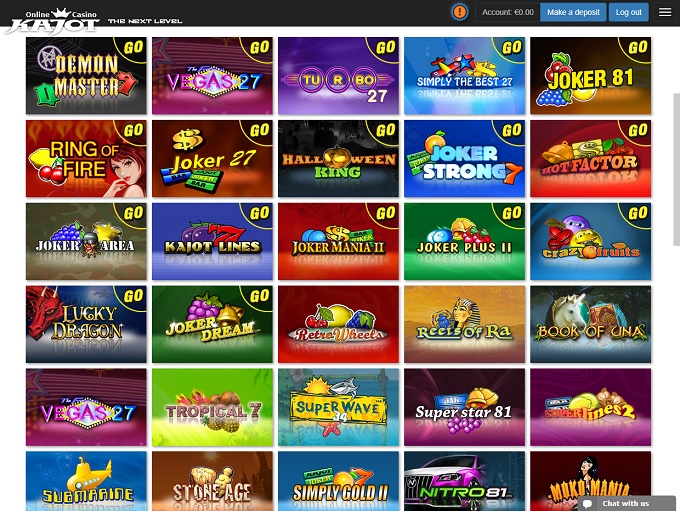

The newest city’s chief streams were based throughout the the individuals ages, plus the dawn of your own 20th millennium saw the development away from South America’s tallest structures and its particular very first below ground system. A second design increase, away from 1945 to help you 1980, reshaped the downtown area and far of your city. Once you’re also no high improvements have been made, profiles can always like to play during the including online gambling enterprises. Online casinos in the Illinois give band of fee running alternatives to fit the varied criteria of the advantages.

Galician code, cooking and you will people had a primary exposure in town to possess the 20th century. Recently, descendants of Galician immigrants have provided a tiny increase inside the Celtic sounds (which also emphasized the newest Welsh life from Patagonia). Yiddish try aren’t heard in the Buenos Aires, especially in the newest Balvanera garment district and in Property Crespo up to the newest 1960s. All brand new immigrants learn Language quickly and you may absorb to the area existence. The newest Buenos Aires Metropolitan Police is actually law enforcement push under the expert of your Independent City of Buenos Aires.

Xavier Deserving 2024 Prizm #M-XWO Manga Circumstances Strike Rookie RC Ohio Urban area Chiefs

You could found only one the new bank account opening relevant bonus all two years in the past discount subscription day and only one to added bonus for every account. Here are a few crucial has to adopt when looking for a premier-yield family savings. When selecting, in addition to look at Bankrate’s pro analysis of preferred financial institutions, many of which offer higher-desire savings accounts. The fresh Rising Lender Higher Yield Family savings also offers an aggressive interest speed but a somewhat large lowest starting deposit of $1,one hundred thousand. You will need to keep at the very least $1,one hundred thousand in the membership to earn the brand new APY. When you’re Chase offers numerous solid membership incentives, it’s however value researching the choices.

- Which have a bonus Bank account (and therefore brings in 4.62% APY), the advantage Savings account produces a highly big speed away from cuatro.50% APY.

- To the a connected mention, absolutely the better rates to your all of our chart has just had been the solution in order to “just who hasn’t yet – however, often – get in on the latest bullet of decrease”.

- Neither Pursue nor Zelle® also provides compensation to have subscribed payments you make having fun with Zelle®, with the exception of a finite reimbursement system one to is applicable without a doubt imposter scams the place you delivered money that have Zelle®.

- Vanguard Brokered Certificates of Places possess some of the highest rates on the market, nevertheless they also come with a risk.

Parents discovered a great debit credit due to their kids, that they may use setting using limits, create offers needs, as well as begin paying. Particular scholar checking profile earnestly limit registration so you can young someone, usually those ranging from 17 and you may 23 or 24 yrs . old. It’s simple to discover a student bank account, as most financial institutions offer the choice on the internet. Chase members gain access to over 15,000 ATMs and you will a robust mobile app to cope with all of your banking requires.

The bucks Application Credit are often used to generate withdrawals out of ATMs and possess cash back in the checkout. CNBC Find talks about Dollars App’s financial have and you can sees exactly how it pile up for the race. Whether you’re saving for an advance payment, disaster fund otherwise old age, having a definite, particular deals mission can help you remain driven and you can tune improvements. Charges will cut in the focus earnings, so be sure to aren’t using this type of. This site are protected by reCAPTCHA and the Privacy policy and Terms of use implement.

Average money industry costs

Specific banking institutions tend to to alter easily, while others will get waiting depending on how much needed to draw deposits. On the internet banking companies, which have down working will cost you, could possibly get keep providing large costs longer than high old-fashioned banking institutions. Because the reduce was just announced, deals prices have not yet altered. Prices to the deals profile basically move off within the lockstep having plan slices. The brand new Presidential Bank Advantage Bank account try a powerful choice for savers looking to discover both an examining and you may savings account and you can score very aggressive cost. With a bonus Family savings (and that produces cuatro.62% APY), the advantage Family savings brings in an incredibly big rates out of cuatro.50% APY.

The guy advised alerting so you can “protect well from the possibility of cutting cost both too much otherwise too quickly”. A part of the rate-function Financial Plan Panel (MPC), Pill told you this morning root rate progress try toostrong and you will highest rising prices traditional risked getting inserted. Interest levels may should be reduce far more slower due so you can stubborninflation, based on Bank out of England head economist Huw Pill. Concerns for local All of us lenders’ experience of bad money have moved on in order to Europe, having banking companies as the greatest fallers to the FTSE 100. There have been, so far today, the biggest every day shed of your own UK’s standard inventory directory within the half a year.

There is certainly a monthly provider costs on the both accounts that will end up being waived for many who fulfill the needs. On the ONB Common Bank account, it is waived when you have an excellent $5,000 everyday balance otherwise look after a $25,100 combined lowest each day balance among their deposit accounts. To your ONB Relaxed Examining, you should buy the cost waived for many who manage $500 in direct places monthly, manage a regular balance out of $750, or look after a mixed daily balance from $1,five-hundred inside put account.